As we begin the caregiving journey, we are mainly concerned about our aging parents’ well-being and safety. This can be a difficult time psychologically for adult children as they watch their parents, once vital and in charge, become frail and in need of help. In the rush to deal with day-to-day problems and scramble to figure out what to do if Mom or Dad is having difficulty at home or has a serious health crisis, the financial ramifications are often an afterthought.

However, sooner or later, finances will become a key part of the mix, whether we end up paying for incidentals, managing or coordinating parents’ finances, or paying outright for their care. It is not unusual for family caregivers to take on all three financial roles. A recent study finds that 92% of caregivers are “financial caregivers” along with more traditional caregiving responsibilities. Often people aren’t aware of what they are spending or how much time they devote to helping out with paperwork until they are deep into their caregiving responsibilities.

Paying out-of-pocket expenses

Whether aging parents or other loved ones are well off financially or not, family caregivers usually don’t think twice about picking up groceries, items from the drug store or medical supplies. And if they live in a different location from their parent, they are quick to get in their car or fly to a destination if a crisis occurs or simply to make sure things are okay.

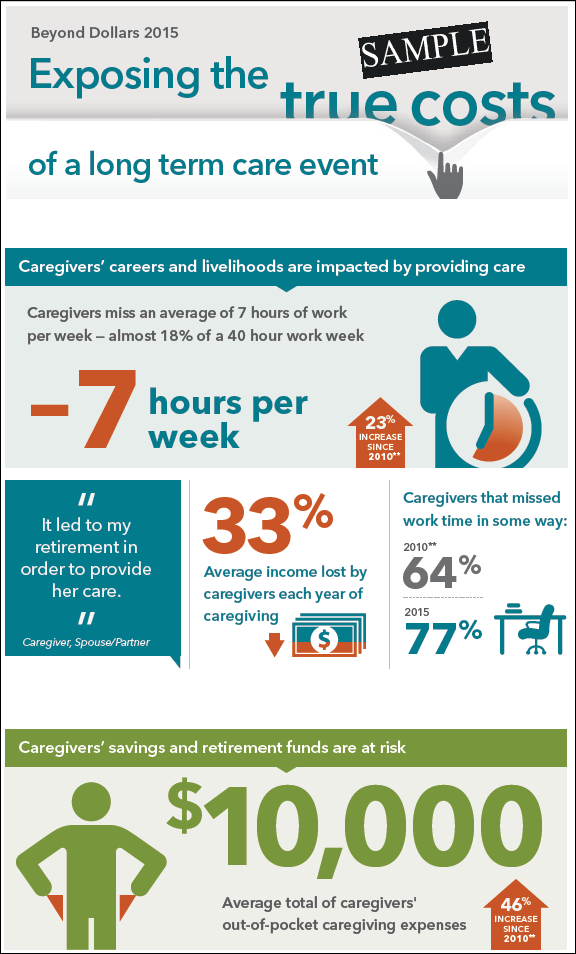

Expenses for gas, airfare and all the incidentals can really add up. Caregivers spend an average of $6,954 yearly for out of pocket expenses, and for long-distance caregivers, the cost is nearly doubled. On average, those who care for someone who lives far away spends $11,923 per year. These expenses are generally unbudgeted and can take an unbudgeted bite into a family’s savings.

Coordinating and managing finances

It’s not unusual for someone who needs care or has a serious visual impairment to be overwhelmed by the paperwork generated from Medicare, insurance, utilities, and savings and checking accounts. Even if a parent has a financial professional, the day to day work involved of making sure bills are paid, taxes filed, accounts monitored, and insurance premiums and claims under control is part of this responsibility. Keeping track of legal documents such as powers of attorney, living wills and other safeguards also needs to be managed by someone. And that someone is usually a family caregiver.

Taking on this role has some pitfalls as parents are often reluctant to turn over anything related to money to their children. But it is an important role, because it enables the caregiver to make sure that the bills don’t stack up and that there are no suspicious expenditures. The annual loss to victims of financial elder fraud and abuse is estimated to be $3 billion a year; some estimate it could be as high as $36 Billion as four out of five incidents go unreported.

Whether fraud is an issue or not, financial caregivers find themselves spending many hours coordinating finances and making sure that their parent’s money is safe and secure.

Paying for care

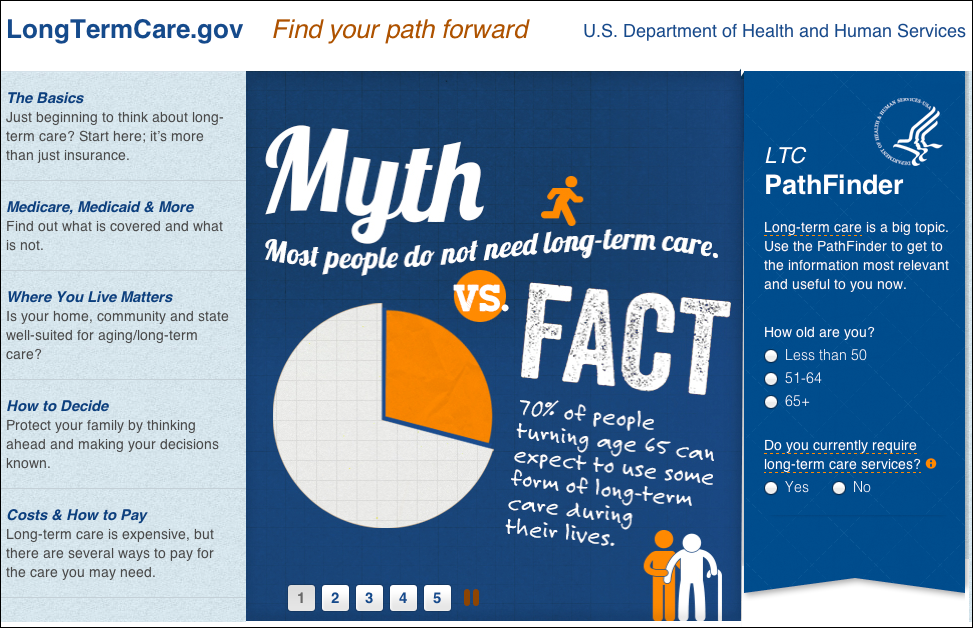

As financial caregiving escalates and care needs increase, caregivers may need to confront a harsh reality. They may find that their parents don’t have enough money saved to afford paid care, whether at home, in an assisted living facility or nursing home, and do not have long-term care insurance protection. It’s also possible that assets have dwindled after one of their parents had to spend down savings to pay for the other spouses’ care.

The cost of care increases each year. The average rate for paid home care is now at $22 per hour and assisted living at $3.750 (base rate) per month. Studies indicate that about half of adult children feel an obligation to pay for their parents’ care should they need it. But families are often struggling with their own finances, worried about college tuition payments, mortgages, possible job loss and their need to save for their own retirement.

Transferring parents’ assets to a daughter or son, once considered a viable option, is risky and not always foolproof. Most states have look back periods, and thirty of them now have Filial Responsibility laws on the books requiring adult children to repay for the cost of care incurred by the government. While rarely enforced, a few lawsuits are currently pending. With state budgetary shortfalls in the news, it’s likely that these laws will have more teeth in the future.

Lost lifetime wealth

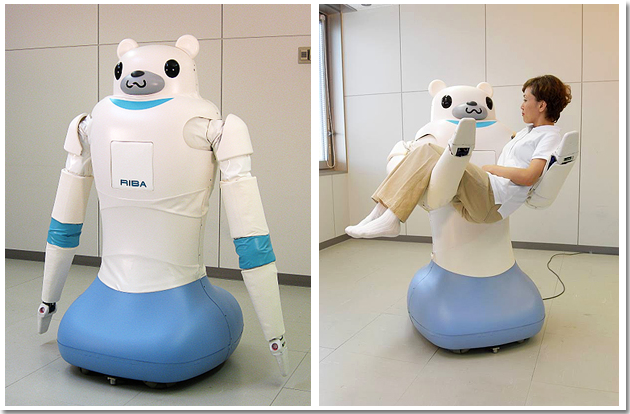

An alternative to paying for care directly is to ask a parent to move in, or as another option, to assume the caregiver role. For those who do the math, it may seem logical at first to leave the workforce altogether or step back to part time and become the primary caregiver. Paying for round-the-clock care is costly. Even if parents have money, the stress and emotions of providing care may drive a caregiver to stop working. Women, in particular, who take on intense caregiving roles, are more inclined to see this as an option and decide to cut ties with employment.

However, more sophisticated calculations show that a workforce departure or step-back can result in a significant blow to long-term retirement finances. For men, the loss of wages and benefits over a lifetime amounts to $284,000. It’s even worse for women at $324,000. People who do drop out often don’t think of the subtle ramifications in addition to the missed years of earnings and income growth. They forget about the 401 (k) match, the value of employee benefits, the career trajectory, and the roadblocks they might find when they try to get back into the workforce at the same salary level. Actually, continued employment might be the best thing to do, not only to maintain financial health but also for physical and mental health as well. Caregivers often say that work helps them take a break from the intensity and emotions of caregiving.

So what is a potential strategy?

Both the family and the financial professional can take the initiative and make a difference by confronting the issue of financing care early, before it is too late. A conversation with family members and with an advisor about care planning—who will provide care, where will care be delivered and how will it be paid for—is a very important step. It’s often forgotten or put off. Another topic of discussion with an advisor is what long term care protection options are available, not only to find out whether parents might be eligible but also as a planning tool for the adult children themselves. Financing the quality care that we all want and helping our families cope when they assume caregiving roles should be top of mind and incorporated into any discussion of long-term care.

Be Prepared: Get Long Term Care Insurance Quotes

.

.

.

.